Here an interesting article on how the Dutch are working around the land problem in the country.

Its amazing what people can do, another instance of innovation. We are not bound by the traditional factor of production - LAND.

What do you think about living on water? Do you think its a sustainable thing and a good solution to land issues? Any implications for the water body these houses being built on?

Saturday, March 16, 2013

Friday, March 15, 2013

Working for Google

This Article from the New York Times talks about Yahoo is trying to get more of its workers to work in the office instead of working from home. Marissa Mayer, Yahoo's chief executive, says she is trying to emulate Google, her previous employer. The article then goes on to describe the Google work environment in lavish detail. I won't put down every detail but the East Coast Google headquarters is about the size of a city block, has secret rooms, an ice cream truck inside one of its many cafeterias, a lego playroom, and many areas designed specifically for relaxation. Workers are also allowed to design their own work areas and bring their pets to work. Google's large profit margins make it able to maintain such an extravagant work environment. Google says it is trying to push the boundaries of the workplace. It appears to be working because almost all of Google's employees work at the office and are extremely efficient. This office setting is also supposed to encourage innovation, a quality that Google survives off of.

Do you really think this work environment is what has made Google so successful? Do you think Yahoo could benefit from creating such a work environment? Would you like to work for Google in an office like this?

Do you really think this work environment is what has made Google so successful? Do you think Yahoo could benefit from creating such a work environment? Would you like to work for Google in an office like this?

Obama thinkin' on innovation

Here is an article about Obama's 2$ billion plan to spend on researching cleaner fuels.

This article also talks about the sequester and how the impact will cause

“the nation to feel the loss of important new scientific ideas that now will not be explored, and of brilliant young scientists who now will take their talents overseas or perhaps even abandon research entirely.”

Just thought I'd put it in here... interesting article!

article here

This article also talks about the sequester and how the impact will cause

“the nation to feel the loss of important new scientific ideas that now will not be explored, and of brilliant young scientists who now will take their talents overseas or perhaps even abandon research entirely.”

Just thought I'd put it in here... interesting article!

article here

Thursday, March 14, 2013

New Detroit Manager Is Optimistic on Turnaround

For those who care about Detroit and the Metro-Detroit area, this article talks about the new emergency financial manager of Detroit, Kevyn Orr, who was appointed earlier today by Governor Rick Snyder. Detroit has a lot of debt, is this move a little too late? Thoughts on the article?

Innovation is not always needed....

To add a few giggles as you write your reflections....

French Toilet Paper Ad: 'Emma' By Le Trefle Proves Both French Husbands & Technology Wrong (VIDEO)

French Toilet Paper Ad: 'Emma' By Le Trefle Proves Both French Husbands & Technology Wrong (VIDEO)

More on innovation...

For our discussion today, I found this pdf doc. on a plan to implement innovation in the American economy, "our future economic growth and international competitiveness depends on our capacity to innovate." This paper is pretty long, but the summary is in the first few pages. Basically is the administration, american people, and businesses can work together to work towards future full of innovative ideas, it can lead to jobs and economic prosperity. I know we have talked a lot about it in class, but I just thought this was an interesting find. What do you all think? Obviously innovation is a great thing, but is our economy ready for it now?

Innovation and stuff...

Innovation and stuff...

Lower Unemployment and Higher Markets: A Sign of Things to Come?

This Article from the New York Times talks about how new unemployment benefit filings have been declining these past two weeks. This has been reflected on Wall Street, which has been on a hot streak as of late. In fact, the DOW has risen for nine straight days now, a streak not seen since late 1996.

Do you think the decrease in unemployment claims is somehow causing this hot streak on Wall Street? Is it going to last or are things going to slow down again soon?

Wednesday, March 13, 2013

Can Culture Changes Fix Distressed Companies?

This Article from the WSJ talks about how Bob Flexion, the new Chief Executive of Dynegy, is trying to save his company by changing the general culture of the company. He has already done things like move out of the expensive executive office his predecessor used and into a cubicle with his fellow employees, as well as moving the company to a cheaper building. This move will save the company 5 million dollars per year. He has also made his workers more efficient by not allowing them to mess around on their phones or the internet while working.

Do you guys think that this culture change will help save Dynegy? Should other struggling companies follow Mr. Flexion's example? Is this idea of more efficient workers and more frugal executives perhaps what this country's economy needs as a whole?

Balanced Budget Fight

"While economists generally agree that narrowing the government’s deficit and limiting the size of the debt are necessary in the long run, most argue that balancing the budget would not restore the nation’s still-weak economy to health in the near term."

The article mentions that it is more important to slow the deficit growth rather than eliminate it.

Economists in the article also suggested, "Closing the budget gap over the longer term could be vital to sustaining economic health, some stressed, by ensuring that the government did not crowd out private investment and by helping to keep interest rates low."

The article also gives a stat that public debt in the U.S. is about 76% of the size of the economy...

Republicans and Democrats fight on the deciding to get back to a balanced budget or not... what do you all think? There is talk about fiscal policy? Thoughts?

click here----> Balanced budget...

The article mentions that it is more important to slow the deficit growth rather than eliminate it.

Economists in the article also suggested, "Closing the budget gap over the longer term could be vital to sustaining economic health, some stressed, by ensuring that the government did not crowd out private investment and by helping to keep interest rates low."

The article also gives a stat that public debt in the U.S. is about 76% of the size of the economy...

Republicans and Democrats fight on the deciding to get back to a balanced budget or not... what do you all think? There is talk about fiscal policy? Thoughts?

click here----> Balanced budget...

Would anyone give you 10 million dollars to run for office?

On average, Senators raised 10.5 million in their campaigns while House races cost on average a paltry 1.7 million.

What it costs to win a Congressional election - The Week

What it costs to win a Congressional election - The Week

Tuesday, March 12, 2013

Flammable ice-- a possible new energy source

'Japan said Tuesday that it had extracted gas from offshore deposits of methane hydrate — sometimes called “flammable ice” — a breakthrough that officials and experts said could be a step toward tapping a promising but still little-understood energy source.'

Going off of the video we watched today about innovative research could help our economy in many ways check out this article! A possible new energy source. This could be a possible alternative to oil and gas reserves. The article mentions that Japan invested millions to research and explore these reserves and have finally found this powerful energy source... experts predict lasting Japan 100 years of their natural gas needs.

There are still questions about environmental issues that could result from this new source. But what do you think? A step in the right direction? Doesn't this show that researching and developing new ideas will help an economy?

Japan's Energy Find

Going off of the video we watched today about innovative research could help our economy in many ways check out this article! A possible new energy source. This could be a possible alternative to oil and gas reserves. The article mentions that Japan invested millions to research and explore these reserves and have finally found this powerful energy source... experts predict lasting Japan 100 years of their natural gas needs.

There are still questions about environmental issues that could result from this new source. But what do you think? A step in the right direction? Doesn't this show that researching and developing new ideas will help an economy?

Japan's Energy Find

Detroit automakers rethink small trucks

This Article talks about how the "Big Three" (Chrysler, Ford, and GM) automakers in Detroit are looking to get back into the small pickup truck market after abandoning it in the U.S. due to weak demand. Rising fuel prices have convinced the Big Three to consider reentering the small pickup market with its own fleet of smaller, more fuel efficient trucks. Toyota is the current market leader in the small pick up market with its Tacoma. The Big Three hope to regain their share of the market with these new smaller trucks. In addition to better fuel economy, The Big Three hope to appeal to "price sensitive, younger buyers" who will then hopefully turn away from rival auto dealers and build up consumer loyalty. The downside to these smaller pick ups is they do not make as big a profit as the full size trucks do.

"Barclays Capital estimates auto companies earn between $7,000 and $10,000 on each full-size pickup because they command higher prices in dealer showrooms, while midsize trucks bring closer to $3,000 to $4,000 a vehicle."

Do you think these small trucks are a good idea for the Big Three? Do you think consumers will go for these smaller trucks instead of a full size pick up or a different type of car all together?

Monday, March 11, 2013

Facebook reveals your secrets...

I found this article in Financial times and found it kind of interesting... especially since I know there are people who are applying for jobs and internships, you might want to take a look at what businesses might start doing with your Facebook, and how your personal information might affect you in your future interviews.

article here

article here

Fight of the Century: Keynes vs Hayek Round 2

As you guys may recall, a few weeks ago we watched a Youtube video in class in which John Maynard Keynes and F.A. Hayek engaged in a rap battle about their views on government spending in the economy. Hayek represented the Classical perspective while Keynes represented the Keynesian perspective, obviously. If you guys enjoyed the video then I think you will enjoy the sequel to it, which I personally thought was better than the first one.

So after watching the video (for those who actually watched the video), who do you think won the battle? Did the arguments by Keynes and/or Hayek change your view on the economy at all?

What Bernanke Has to Say

Check out this article by Bloomberg News highlighting Ben Bernanke's discussion of how the FED is going to stimulate the economy. This post is a great follow up to the pervious post about Bernanke being a market mover. The article is a perfect overview of what stimulus policy in the United States looks like today. Videos of Bernanke speaking to the House Financial Services Committee on February 27th are also included on the link.

What did you learn from the article? With all the material on monetary/fiscal policy we have been reading and discussing, what do you think is a viable solution? Do you think Koo's argument against monetary policy holds here?

What did you learn from the article? With all the material on monetary/fiscal policy we have been reading and discussing, what do you think is a viable solution? Do you think Koo's argument against monetary policy holds here?

Sunday, March 10, 2013

Stocks wrap up Historic Week

Here is a video from CNBC about DOW jumping up about 307 points! Check out this video, what do you think about what these people are arguing about stocks? Remember the mind over money video? They seem to feel pretty positive about this increase in stocks. What do you guys think is going to happen in the future with these stocks?

video

video

Saturday, March 9, 2013

The Problem with Banking: an Addiction to Debt

This week, we grappled with how to solve the mess of the banking system. It seems out of control, yet the financial system is vital to the functioning of the economy. We get angered by bailouts, and yet without them, the economy collapses. What's the ideal policy?

It seems like thinkers on the left like Matthew Yglesias and on the right like John Cochrane have been taken in by the argument presented in "The Banker's New Clothes", which professor McKinney mentioned in class. It seems like the core of the argument is that because the government subsidizes bank debt both implicitly through bailouts and in some explicit ways, banks (surprise surprise) take on too much of it. The solution: stricter capital requirements.

Cochrane lays out the book's case well, writing:

I'm not so convinced, and it seems to me that this is a problem of incentives. If we're going to subsidize bank debt, then it makes sense to control how much debt banks can have. That seems more productive than wishing bankers were less greedy or trying to enforce 3,000 more pages of regulations.

It seems like thinkers on the left like Matthew Yglesias and on the right like John Cochrane have been taken in by the argument presented in "The Banker's New Clothes", which professor McKinney mentioned in class. It seems like the core of the argument is that because the government subsidizes bank debt both implicitly through bailouts and in some explicit ways, banks (surprise surprise) take on too much of it. The solution: stricter capital requirements.

Cochrane lays out the book's case well, writing:

"More capital and less debt would stabilize the financial system in many ways. If a bank wants to rebuild its ratio of capital to assets from 1% to 2% by selling assets, it has to sell half of its assets. Doing so can spark a fire sale, especially if all the other banks are doing the same thing. If the same bank wants to rebuild capital from 49% to 50% of assets, it only has to sell 2% of its assets."What I like best about this argument is that it focuses on what economics can understand and do something about: incentives. The documentary we watched, while interesting, seemed intent on focusing on some moral element of the financial crisis. There were villains who frequented brothels and bought expensive jets while crashing the economy, and there were noble heroes who could've saved us if only we'd listened!

I'm not so convinced, and it seems to me that this is a problem of incentives. If we're going to subsidize bank debt, then it makes sense to control how much debt banks can have. That seems more productive than wishing bankers were less greedy or trying to enforce 3,000 more pages of regulations.

Private Sector

In this article we get a sense that the economy has a good reason to be out of a recession. It talks about how the private sector is actually hiring and picking up the slack the government is leaving behind, yet the government has yet to start backing off some more. Do you think this is a smart move by the government? Why? Is the fact that the job growth is across the board a good or bad thing? Higher paying jobs could give the economy the boost it needs, as long as consumers continue to spend their money instead of saving it, right?

Too big to prosecute

From the Baseline Scenario:

In a recent interview with PBS’s Frontline, Lanny Breuer – head of the criminal division at the Department of Justice – appeared to admit that some financial institutions were too big to prosecute. In the “too big to fail is too big to jail” controversy that ensued, lobbyists and other supporters of big Wall Street firms tried all kinds of complicated ways to spin Mr. Breuer’s words.

Their job got a lot harder yesterday when Eric Holder, the attorney general, stated clearly to the Senate Judiciary Committee,

Putting aside the rhetoric of capitalism and the sanctity of private enterprise, the function of the financial system is to create money to be used in the economy and to allocate capital to the most productive uses.

Read the full blog post at:

“Some Of These Institutions Have Become Too Large” | The Baseline Scenario

In a recent interview with PBS’s Frontline, Lanny Breuer – head of the criminal division at the Department of Justice – appeared to admit that some financial institutions were too big to prosecute. In the “too big to fail is too big to jail” controversy that ensued, lobbyists and other supporters of big Wall Street firms tried all kinds of complicated ways to spin Mr. Breuer’s words.

Their job got a lot harder yesterday when Eric Holder, the attorney general, stated clearly to the Senate Judiciary Committee,

“I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy,” (Watch the video for yourself.)

According to Mr. Holder, speaking as the top enforcer of the country’s laws, “some of these institutions have become too large.”Putting aside the rhetoric of capitalism and the sanctity of private enterprise, the function of the financial system is to create money to be used in the economy and to allocate capital to the most productive uses.

Read the full blog post at:

“Some Of These Institutions Have Become Too Large” | The Baseline Scenario

Friday, March 8, 2013

Ben Bernanke Is Greatest Market Mover of Them All

This article just shocks me when I know that "markets move more when Federal Reserve Chairman Ben Bernanke opens his mouth than they do when any other Fed official speaks." Do you agree with the author? Do you think Ben Bernanke deserve to be the greatest market mover?

Buy Back Time

In this article it is talked about how U.S. companies are finally helping out their investors. There are plans of buying back over 117 billion dollars of their own shares making stocks a lot more valuable. My question is are we jumping out of "bunker down mode" too quickly? Could we maybe be causing a false start? And is this going to benefit everyone in our economy? How so?

Why the law isn't just the law once it is passed

A great story in The Washington Monthly explains the rule-making process that accompanies new laws. Someone has to interpret the law and that creates an opportunity to game the law. Read the story:

The Washington Monthly - The Magazine - He Who Makes the Rules

The Washington Monthly - The Magazine - He Who Makes the Rules

Thursday, March 7, 2013

Banks' Health on the Mend

In class, we have been talking a lot about the weakness of banking industry so I think this article will bring us a promising new about banks' health. "The Federal Reserve served notice that the financial industry's health

continues to improve, potentially clearing the way for large U.S. banks

to funnel tens of billions of dollars to investors in increased dividend

payments and share buybacks." Do you think this is a good sign that the economy is recovering and this is enough to bring investors' confidence back?

What Mainstream Economists Believe

A fascinating project that came into being last year is the IGM Economic Experts Panel. The panel asks dozens of economists from the most prestigious universities what their views are on a variety of policy issues. Each economist responds with Strongly agree, agree, uncertain, disagree, or strongly disagree and indicates a level of confidence on their response.

Take a look through the list of polls, the panel has been posed all sorts of fascinating questions. What I find striking is that there is a large degree of agreement amongst mainstream economists on a wide variety of issues. One common criticism of the panel I've heard is that it doesn't represent some of the "fringe" views in economics, like Austrians or Marxists. Nonetheless, it's interesting to see what some of the biggest names in economics can and cannot agree on.

Take a look through the list of polls, the panel has been posed all sorts of fascinating questions. What I find striking is that there is a large degree of agreement amongst mainstream economists on a wide variety of issues. One common criticism of the panel I've heard is that it doesn't represent some of the "fringe" views in economics, like Austrians or Marxists. Nonetheless, it's interesting to see what some of the biggest names in economics can and cannot agree on.

Households and Borrowing

In this article, Harm Bandholz, chief U.S. economist at UniCredit, believes that this is the year deleveraging of households ends. Do you agree/believe him? Is there a reason to be optimistic about the housing market? And does the net worth of U.S. households has rising 29% since 2009 impress you? The article also touches on the subject of borrowing, and how American consumers are starting to borrow more and deleverage less. Is this a good thing for our economy coming out of a recession? Will interest rates be able to stay low to keep encouraging people to borrow?

To a MMTer: the Fed should forget about issuing bonds

Open market operations are okay but currency and bonds are fairly interchangeable. The government does not need the banking system to create money: in a fiat system, it can print all we need.

In a fiat-money system, governments have the capacity to pursue full employment and price stability at all times by endeavouring to keep the budget deficit in line with non-government net saving intentions. The practice of issuing government debt in such a system is a meaningless exercise, and choosing to focus on government debt as a policy target at the expense of full employment amounts to behaving as if the government is operating under a commodity-backed monetary regime and faces the same socially destructive constraints.

Parable of a Monetary Economy | heteconomist.com

In a fiat-money system, governments have the capacity to pursue full employment and price stability at all times by endeavouring to keep the budget deficit in line with non-government net saving intentions. The practice of issuing government debt in such a system is a meaningless exercise, and choosing to focus on government debt as a policy target at the expense of full employment amounts to behaving as if the government is operating under a commodity-backed monetary regime and faces the same socially destructive constraints.

Parable of a Monetary Economy | heteconomist.com

More on modern monetary theory

It tries to differentiate real economy fundamentals from monetary fundamentals. But what makes it different from other theories about money is that it views fiat money creation as enabling private wealth creation:

[In a] country like the United States, which issues its own freely floating fiat currency, can always make the policy choice to issue whatever quantity of that currency it deems appropriate. The US government can spend as many dollars into the private sector economy as it chooses, without obtaining those dollars from some other source first, and it can always pay any debts that have been incurred by borrowing dollars. But the critics will go on to charge that MMT mistakenly concludes from these few institutional and operational facts that there are no economic limits to the wealth-generating capacities of the government. .....

Money is a medium of exchange and exists to help the real economy work better.:

The monetary system is best seen as a public utility that is employed by its users to finance the production and exchange of goods and services. It is a system of institutions created by human beings to help realize opportunity, and match opportunities for the creation and transfer of goods with the potential producers and recipients of these goods. It’s our monetary system, and we can do whatever we want with it to achieve our society’s full potential. We can create, destroy, transfer or manipulate the monetary medium of exchange as we see fit to advance the good of society and improve the condition of our people. Thus there can be no such thing as an economic limit due solely to our society as a whole being “out of money”. That’s like saying we can’t organize better schools, or write more and better books because we have run out of words.

Deficits do not have to be bond financed. The government can print money without creating a hyperinflation because:

If a government wishes to increase its deficit, doesn’t it necessarily have to borrow to cover the larger gap between revenues and spending? No, it does not. A government that is the issuer of its own currency has the option of increasing its deficit without increasing bond sales. It can issue new money in the very act of spending it.

(see link here )

In more economic terms, the basic principles are:

[In a] country like the United States, which issues its own freely floating fiat currency, can always make the policy choice to issue whatever quantity of that currency it deems appropriate. The US government can spend as many dollars into the private sector economy as it chooses, without obtaining those dollars from some other source first, and it can always pay any debts that have been incurred by borrowing dollars. But the critics will go on to charge that MMT mistakenly concludes from these few institutional and operational facts that there are no economic limits to the wealth-generating capacities of the government. .....

Money is a medium of exchange and exists to help the real economy work better.:

The monetary system is best seen as a public utility that is employed by its users to finance the production and exchange of goods and services. It is a system of institutions created by human beings to help realize opportunity, and match opportunities for the creation and transfer of goods with the potential producers and recipients of these goods. It’s our monetary system, and we can do whatever we want with it to achieve our society’s full potential. We can create, destroy, transfer or manipulate the monetary medium of exchange as we see fit to advance the good of society and improve the condition of our people. Thus there can be no such thing as an economic limit due solely to our society as a whole being “out of money”. That’s like saying we can’t organize better schools, or write more and better books because we have run out of words.

Deficits do not have to be bond financed. The government can print money without creating a hyperinflation because:

If a government wishes to increase its deficit, doesn’t it necessarily have to borrow to cover the larger gap between revenues and spending? No, it does not. A government that is the issuer of its own currency has the option of increasing its deficit without increasing bond sales. It can issue new money in the very act of spending it.

(see link here )

In more economic terms, the basic principles are:

- The Federal Reserve and the government have a symbiotic relationship and together are issuers of the currency to the monetary system. Households, businesses and state governments are users of public sector supplied currency and also private bank issued monies (i.e. bank deposits).

- The private banking sector issues bank deposits (“inside money”) and the public sector issues coins, paper cash and banking sector reserves (“outside money”). Nowadays most market exchanges involving private agents are transacted in bank deposits and, as such, the ins and outs of “inside money” are vital to understanding how the modern monetary system functions. While the private sector component of the monetary system takes center stage in the daily business of market exchanges and economic progress, the public sector also plays an important facilitating role.

- As the issuer of the currency, there is no solvency constraint at the government level as there might be for a household, state or business. In this regard, one must be careful comparing the federal government to a household because the federal government has no solvency constraint (i.e., there’s no such thing as the federal government “running out of money” as it can always call on the banks and the Federal Reserve to serve as agents of the government). Households, on the other hand, have a very real solvency constraint.

- The federal government’s true constraint is never solvency, but inflation. The government must manage the money supply so as to avoid imposing undue harm on the populace via mismanagement of the money supply.

- The modern floating exchange rate system helps to maintain equilibrium and flexibility in the global economy.

- The currency denomination of debt is very important to assessing the sustainability of public finances. When a government issues debt payable in the domestic currency unit these assets are essentially default-free. (The exceptions are when policymakers “self-impose” constraints that forbid the central bank from acting as the government’s banker as per Euroland).

- The government is an entity created by the people and for the people. It exists to further the prosperity of the private sector – NOT to benefit at its expense. If this entity is allowed to exist for its own benefit or becomes corrupted by a concentration of power or abuse of its currency issuing powers it will become susceptible to dissolution via the populace’s rejection of that government.

- Governments should be actively involved in regulating and helping build the infrastructure within which the private sector can generate economic growth. The economy is a complex dynamical system with irrational participants. The market cannot be expected to regulate itself or behave rationally at all times. Therefore, some level of government intervention and involvement is not only beneficial, but also necessary. While government assists in the economic process it is ultimately the private sector that is the primary driver of innovation, productivity and economic growth. It is the private sector that propels increases in living standards with its activities the most important factor in giving value and viability to the currency.

- The unit of account or medium of exchange within a specific nation is ultimately a creature of law. It must therefore be regulated by the state; however, ultimately the private sector must accept this legal tender as the currency unit. Therefore, the private and public sectors should best be thought of as being in partnership with one another and not opposing forces. Government by the people and for the people is not the antagonist in this story, but rather an entity that should be best utilized to maximize private sector prosperity.

- Government deficit spending and tax collection should be maintained at a rate that does not impose financial hardship on the private sector. Because the Federal government is not a business or household it should not manage its balance sheet for its own benefit. Rather, taxes and government spending should be managed in a way that most benefits the private sector and encourages private sector prosperity, productivity, innovation and growth.

Wednesday, March 6, 2013

JC Penny sees bad time continuing

Ron Johnson, the former retail boss at Apple became CEO of JC Penny store chain in November 2011 and he was expected to bring JC Penny out of the bad time. Using his Apple's magic, he turned in what were probably the worst quarterly results ever in the history of major retail: same-store sales were down 32 percent in Q4 2012, to $3.8 billion. The clock is ticking for J.C Penny and CEO Ron Johnson is running out of time. The board member of J.C Penny's patience is wearing thin and they are considering selling the company or replacing the chief executive. What is your opinion? Why does Apple's magic and retail operations not work in J.C Penny? What should they do now? What is the strategy for J.C Penny to bring back their consumers?

Yesterday, Hugo Chávez, President of Venezuela, die at 4:26pm. He was not an ordinary person. His influence around Latin American and challenges to the U.S. gave a new concept of a regional leader in Latin America. "Still, Dr. Antolinez called Mr. Chávez a historical figure with the stature of Simón Bolívar, the South American independence hero, or even Joan of Arc". However, this is the half of the story. Mr. Chávez was also a chameleon, taking on and shedding policies and programs as they suited him. Those are some of the examples:

His death plunged Venezuela into political uncertainty not only in political aspects, but also in the economy area. I urge you to beyond the boundaries and analyze that case through this article. Which are the implications of Chávez's death in Venezuela, Latin America, and the World?

- He was a self-described Socialist who expropriated private businesses and property but looked the other way as opportunists enriched themselves off government contracts.

- He preached about economic independence and created chains of subsidized grocery stores but neglected agriculture and relied heavily on imported food.

- He excoriated capitalists and lectured about service to the country but tolerated or ignored widespread corruption.

- He condemned the United States at every turn but depended on it to buy the oil that made his movement possible.

His death plunged Venezuela into political uncertainty not only in political aspects, but also in the economy area. I urge you to beyond the boundaries and analyze that case through this article. Which are the implications of Chávez's death in Venezuela, Latin America, and the World?

Spend on infrastructure now - even if there's no multiplier

Yesterday I made a post talking about John Cochrane's argument against Keynesian economics. However, even in his post Fiscal Stimulus RIP, Cochrane admits that,

Do you think the government should spend more on infrastructure right now? What adverse effects do you think more infrastructure investment would have? Does Smith's post change your view of the fiscal policy debate?

"Recessions are also a good time to build needed infrastructure or engage in other good investments, properly funded by borrowing. For all these reasons, it is good economics to see deficits in recessions – and surpluses in booms."Noah Smith, an economics professor at Stony Brook University and writer of a great macroeconomics blog, has a post explaining the crux of this argument. Smith writes that U.S infrastructure is in a desperate state of disrepair, cheap unemployed labor is just lying around, and right now we can borrow for up to ten years at negative real interest rates. That's right, people are paying us for the privilege of lending money. If there is a Keynesian multiplier, that's just icing on the cake!

Do you think the government should spend more on infrastructure right now? What adverse effects do you think more infrastructure investment would have? Does Smith's post change your view of the fiscal policy debate?

My pay check is on the fritz

This article talks about how the house has approved the stop gap budget deal, which is just extending the cuts that went into effect on march 1. Not only did this happen 5 days later but also happened because the federal government will have to close down if it does not. Now congress may be slow to get things done but when it comes to their pay check it seems like they work very fast. Do you think that there should be more accountability in the house and senate? What might be the the different frameworks for future budgets that democrats and republicans are working on? Can we ever get ourselves out of debt?

I'd rather be a banker.....

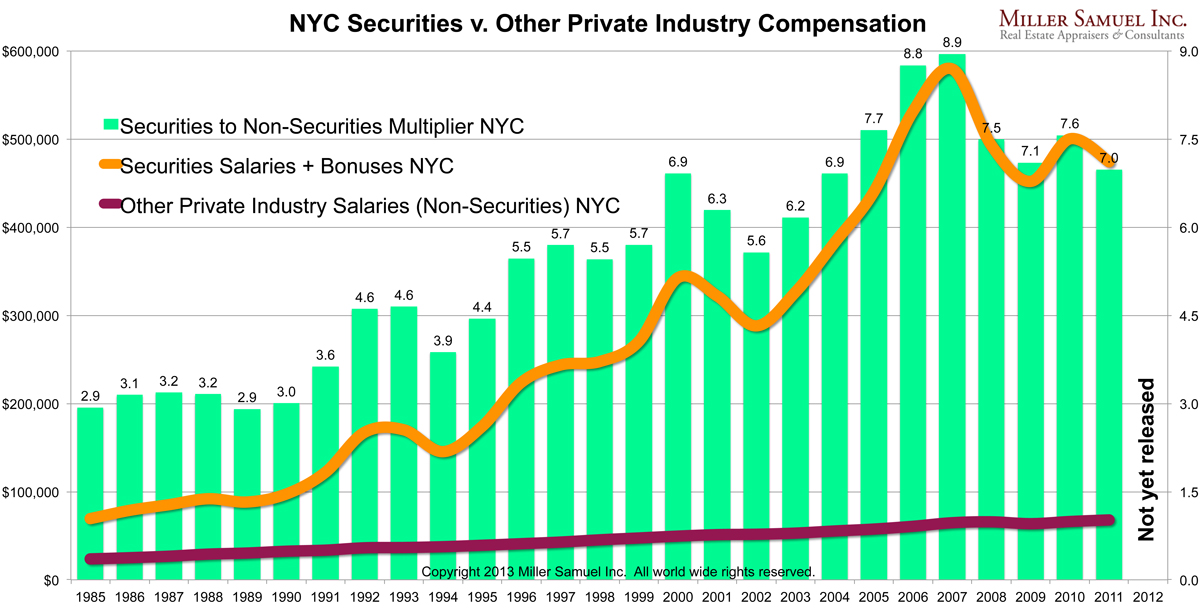

From Barry Ritzolz's The Big Picture Blog, data shows that Wall Street jobs are seven times more lucrative than other private jobs in the United States.

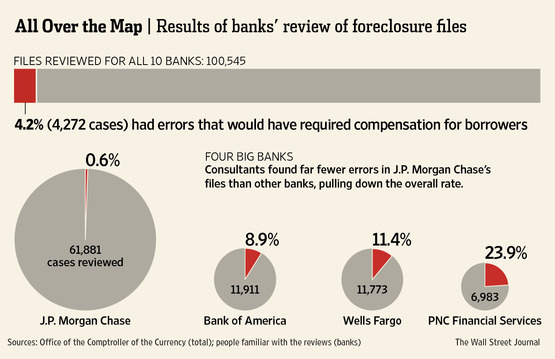

Fraud and mortgage settlements

The largest banks settled with the feds. But this is the issue that everyone is talking about right now. Did the feds settle too quickly?

Tuesday, March 5, 2013

Too- Big- To- Fail

Today in class we talked about "too big to fail" so I found a relevant article. Federal Reserve governor Jerome Powell acknowledged that the issue 'too big to fail" hasn’t been resolved. However, he stated that: “The too-big-to-fail reform project is massive in scope. In my view, it holds real promise. But the project will take years to complete. Success is not assured”

What do you think? Do you think this reform project is promising? What regulations should be changed under Obama administration to save business from collapsing?

What do you think? Do you think this reform project is promising? What regulations should be changed under Obama administration to save business from collapsing?

Argument against Keynesianism

We've talked a lot in class about the Classical model versus the Keynesian model. Often, the classical argument gets summarized as, "the government can't do anything right, the AS curve is vertical, prices fully adjust." I wanted to offer up a more in depth classical criticism of Keynesianism for us to consider.

You may remember John Cochrane from the PBS documentary we watched. Cochrane also has a blog where he frequently rails against stimulus. One of his posts, Fiscal Stimulus, RIP summarizes his arguments against the idea of a fiscal multiplier.

Reading through Cochrane's post helped me understand why classicists believe the things they do. The crux of Cochrane's argument rests on the theory of Ricardian Equivalence:

What do you think of Cochrane's arguments? Do they change how you think of the Classical vs. Keynesian debate?

Update: I fixed my links!

You may remember John Cochrane from the PBS documentary we watched. Cochrane also has a blog where he frequently rails against stimulus. One of his posts, Fiscal Stimulus, RIP summarizes his arguments against the idea of a fiscal multiplier.

Reading through Cochrane's post helped me understand why classicists believe the things they do. The crux of Cochrane's argument rests on the theory of Ricardian Equivalence:

"But here’s the catch: to borrow today, the government must raise taxes tomorrow to repay that debt. If we borrow $1 from A, but tell him his taxes will be $1 higher (with interest) tomorrow, he reduces spending exactly as if we had taxed him today! If we tell both A and B that C (“the rich”) will pay the taxes, C will spend $1 less today."Deficit spending today leads to fear of taxes tomorrow that reduces spending today, muting any stimulative effect. Obviously, Ricardian Equivalence makes some bold assumptions about the ability of consumers to anticipate and save for future taxes, but Cochrane insists that Keynesian advocates should have to explain why they think the assumptions are wrong and adjust their theory accordingly.

"Well, maybe some other Barro assumption is wrong. Yes, there are many. (“Liquidity constraints” are a common complaint, keeping people from acting based on their estimation of the future.) But if you take any of them seriously, the case for stimulus becomes similarly circumscribed. Each specifies a channel, a “friction,” something fundamentally wrong with the economy that matters some times more or less than others, that restricts what kinds of stimulus will work, and that can be independently checked. And in many cases, these “frictions” that falsify Barro’s theorem suggest much better direct remedies, rather than exploitation by fiscal stimulus."Cochrane also makes a very good point when he mentions that because economists can't do controlled experiments, it's risky to rely on "empirical evidence" over theory.

"I am also dubious about empirical work in the absence of theory. If you don’t know how stimulus can work, can you productively look for it? Is this like empirical work on the existence of UFOs? Seriously, the violations of Barro’s theorem that might make stimulus work at one time or place are surely different than those which make it work in another time or place. Surely empirical evaluation must tie to measurement of which of Barro’s assumptions one feels does not hold."Cochrane insists that without theory to guide us, empirical evidence will be quite useless, something that runs counter to Quiggin's argument in "Zombie Economics".

What do you think of Cochrane's arguments? Do they change how you think of the Classical vs. Keynesian debate?

Update: I fixed my links!

Record Breaker

In this article we can see how Dow has broken its record high and is still going up. Yet the expectation was for stocks to fall with the sequester put into place. Why do you think Dow is on the rise? Also in the article, analysts say that the stock market has become a bull market. Do you agree that the stock market is a bull instead of a bear? Why?

Monday, March 4, 2013

A Smart Investor Would Skip the M.B.A.

"Why spend six figures on a business degree? Students would do better to train and network on their own."

In this article, Mr. Stephens- the author of "Hacking Your Education," suggests that students should skip the M.B.A. Instead of spending $174,400 at Harvard Business School, he thinks students should find and build their network because it will be more valuable to them than an M.B.A.

"Instead of relying on business school to succeed, deliberately practice the skills necessary to become a master in your chosen field. Build a network that supports your professional aspirations. Work on projects that show you can have an impact in the real world, dealing with practical problems." What do you think? Do you agree with his suggestion and his article? If you were granted $174.400, what would you do? Will you choose to be a smart investor or an M.B.A student?

American Jobs

In this article they mostly talk about the lack of jobs in the United States. My question for you guys is why do analysts say the economy is doing better but there has been a lack of unemployment falling? Also is the sequester going to put a huge increase in the unemployment rate? And how is Americans and the worlds confidence effected?

Mind.Blowing Video/Infograph

I try not to carry too much of a political/ideological bias in economics, but I can't help but post this video just because of its significance in terms of raw.concrete.data.

We hear so much talk about 'socialism' in Washington. I've even seen the likes of Obama caricaturized with a Hitler mustache on several unfortunate occasions. But this video makes me wonder, are we really slipping down a path towards 'socialism'? How ridiculous is this claim by quantitative standards? How laughable is the efficacy of Trickle Down Economics when data like this is readily presentable in retort? (make sure you're seated)

We hear so much talk about 'socialism' in Washington. I've even seen the likes of Obama caricaturized with a Hitler mustache on several unfortunate occasions. But this video makes me wonder, are we really slipping down a path towards 'socialism'? How ridiculous is this claim by quantitative standards? How laughable is the efficacy of Trickle Down Economics when data like this is readily presentable in retort? (make sure you're seated)

Krugman and his new book.

I like the idea of videos, if you have a few minutes take a look at Krugman discussing the recession and recovery in his new book

He takes a good look at the impact of austerity worldwide and an interesting take on fiscal stimulus.

http://www.youtube.com/watch?v=pju-kDspvwE

Views of the Business Cycle

I recently found a great series of youtube videos from George Mason University economist Tyler Cowen explaining different views on the business cycle. In four roughly 3 minute videos, he takes a look at the Keynesian, Real Business Cycle, Monetarist, and Austrian theories while commenting on their strengths and weaknesses.

While we've thoroughly explored the Keynesian and RBC perspective in class, I find the Monetarist and Austrian theories to be very interesting videos. Which view do you find most persuasive? Why?

While we've thoroughly explored the Keynesian and RBC perspective in class, I find the Monetarist and Austrian theories to be very interesting videos. Which view do you find most persuasive? Why?

Sunday, March 3, 2013

Is there a way out?

We talked about the sequester a lot this past week. This article talks about how president Obama and house speaker Boehner did not have any progress of working a deal through to negate the sequester. After reading this article, do you believe that our government is capable of having a bipartisan agreement on the sequester? Does this make you lose any faith or confidence in our congress to work through issues like the sequester? How does this lack of progress make you feel?

Saturday, March 2, 2013

The Sequester: What Happened on Friday

This article by

Reuters was published on the morning of March 2nd, after the sequester

was scheduled to take place. On Friday the sequester proceeded after it

wasn't suppose to happen in the first place.

"These cuts are not

smart," Obama said in his weekly radio and Internet address. "They

will hurt our economy and cost us jobs. And Congress can turn them off at any

time - as soon as both sides are willing to compromise."

Though

President Obama disagrees with the cuts, the sequester was still signed off by

him and cuts to agencies directly affected by the will start this week. Check out the rest of the article for details on what exactly these cuts mean for government employees.

Obama and a bipartisan group of congressional leaders failed on Friday

to avoid the deep spending reductions known as the "sequester," which

automatically kicked in overnight in the latest sign of dysfunction in a

divided Washington.

Because of the failure of Congress to make collaborative

decisions, the sequester is not in place.

The article highlights what President Obama feels about the sequester:

Friday, March 1, 2013

Regional Testing of Fiscal Policy

In this article, the author writes about current-day testing of regions of the United States. He ends his article by stating three things: [1] that uncertainty is the main cause of a lagging economy; [2] increased fiscal relief would be beneficial; and, [3] as far as spending cuts and tax increases go, it's an open question. My question is: what do you think the best policies are for the mid-west and Michigan (on a national level) or Detroit and Kalamazoo (on a state level)? Any other thoughts on testing regions of the U.S.?

On a side note, if anyone's interested in hearing a philosophy talk by Lambert Zuidervaart tonight (3/1/13) entitled "Art in Public," it's at 8:00 PM in the Olmsted Room.

On a side note, if anyone's interested in hearing a philosophy talk by Lambert Zuidervaart tonight (3/1/13) entitled "Art in Public," it's at 8:00 PM in the Olmsted Room.

Thursday, February 28, 2013

Beer Monopoly

On the beer-related side of this article, the author writes, "In 1988, Miller and Coors lowered prices on their flagship beers, which

led Anheuser-Busch to slash the price of Bud and its other brands in key

markets. At the time, August Busch III told Fortune, “We don’t want to

start a blood bath, but whatever the competition wants to do, we’ll do.”

Miller and Coors promptly abandoned their price cutting." This is not an illegal practice, however--and continues to this day.

What was more interesting to me is this: "It’s quite possible that the true monopolistic battles of the 21st century will not be among massive corporations but among the self-interested governments. We can only hope that they don’t engage in a trigger strategy of their own." Because national governments legislate the anti-monopoly law their intra-national companies must abide by, what protects us against global monopolies? Other thoughts on the article?

What was more interesting to me is this: "It’s quite possible that the true monopolistic battles of the 21st century will not be among massive corporations but among the self-interested governments. We can only hope that they don’t engage in a trigger strategy of their own." Because national governments legislate the anti-monopoly law their intra-national companies must abide by, what protects us against global monopolies? Other thoughts on the article?

Continuing on the sequester...

http://foxnewsinsider.com/2013/02/24/sen-tom-coburn-i-didnt-support-the-sequester-because-its-a-stupid-way-to-cut-spending/

I found this interesting article and video on the sequester. “The crisis is made up, it’s been created” he said. “I didn’t support the sequester because

that’s a stupid way to cut spending. And I didn’t support increasing

the debt limit because there is no such thing as a debt limit in this

country because we always raise it.”

Found it pretty interesting and since we didn't get to share our powerpoints in class I wanted you guys to have the change to watch it and respond to his claim...

Price Formula for Patented Drugs

The Department of Pharmaceutical in India has developed a formula that they would like to implement to control the prices of patented drugs. The formulaic pricing will help control the pricing of patented drugs and get rid of the discretion that the companies have about their drugs. Do you think that this is a good idea? Is a formulaic approach to drug pricing and eliminating the generic going to work? Should the government step in and help price drugs? Here is the article.

Wednesday, February 27, 2013

Affordable Care Act and Massachusetts

In this article, Dr. Mulligan claims that Massachusetts' model of healthcare does not provide an accurate picture of what the Affordable Care Act will look like on a national level. Thoughts?

Also interesting, the "reader picks" comments (at the time of this posting) are by Massachusettsian skeptics of their current state system noting that it does nothing to quell costs of procedures (money going from government/insurance companies to hospitals) and salaries of doctors. I'm under the impression that both of these will take losses; however, I'm interested to see how this pans out.

Do you believe the ACA to be a necessary, and beneficial program? What pressures will the ACA have on the economy?

Also interesting, the "reader picks" comments (at the time of this posting) are by Massachusettsian skeptics of their current state system noting that it does nothing to quell costs of procedures (money going from government/insurance companies to hospitals) and salaries of doctors. I'm under the impression that both of these will take losses; however, I'm interested to see how this pans out.

Do you believe the ACA to be a necessary, and beneficial program? What pressures will the ACA have on the economy?

"Italian Deadlock Rekindles Anxiety About Euro Zone"

This Article about Europe is interesting. Maybe the euro-zone crisis is not over and Italy is showing it because of this political election? What are your thoughts on how the Eurozone is looking like it has not recovered and may be stuck in the recession because of their austerity measures?

The importance of profits?

From Slate's Moneybox:

The International Federation of the Phonographic Industry reports

today that last year "global recorded music industry revenues rose by an

estimated 0.3 per cent to US$16.5 billion in 2012, the first year of

industry growth since 1999" with digital revenue growing 9 percent.

That's good news for the music industry, but also a sobering reminder

of the extent of the collapse. But what I think is really important to

remember is that this epic decline of the music industry has occurred

during a period of time when it's never been easier for music fans to

find new music to listen to. It's a great example of how the health of

an industry as a generator of profits can become completely detached

from actual human welfare.Beware claims of free markets

Every business owner dreams of monopoly--barriers to entry and higher prices. But what if you can get massive subsidies at the same time? A study by Bloomberg estimates that the largest US bankers have gotten $83 billion dollars from the US government since the crisis. (see here for the story) . Since they published their report, critics have attacked the methodology but not the substance of their argument.

Two policy issues seem most important to me. First, the financial sector is not as profitable as commonly assumed. Second, "Others may come up with different numbers, but the conclusion is the same: Banks get a very big subsidy from taxpayers. This subsidy distorts markets and encourages banks to become a threat to the economy."

Two policy issues seem most important to me. First, the financial sector is not as profitable as commonly assumed. Second, "Others may come up with different numbers, but the conclusion is the same: Banks get a very big subsidy from taxpayers. This subsidy distorts markets and encourages banks to become a threat to the economy."

Tuesday, February 26, 2013

Shadow Banking in China

In this article, the FT reports on China's tightening of policies on shadow banking.

Shadow banking, in a nutshell, is the practice of a non-bank entity facilitating investments. It is mostly off-balance sheet transactions; thus, mostly unknown to the uneducated investor and not held to the same standards as normal loans by regulatory bodies. It makes up a huge volume of today's investment pool.

This may be in poor form, but here's the Wikipedia on it for anyone who wants to know more.

What are your thoughts on this practice? Should there be increased regulation on shadow banking practices? It seems profitable and efficient for all parties involved; however, the lack of regulation on these non-banks acting as loan agents makes for "risky" business practices.

Shadow banking, in a nutshell, is the practice of a non-bank entity facilitating investments. It is mostly off-balance sheet transactions; thus, mostly unknown to the uneducated investor and not held to the same standards as normal loans by regulatory bodies. It makes up a huge volume of today's investment pool.

This may be in poor form, but here's the Wikipedia on it for anyone who wants to know more.

What are your thoughts on this practice? Should there be increased regulation on shadow banking practices? It seems profitable and efficient for all parties involved; however, the lack of regulation on these non-banks acting as loan agents makes for "risky" business practices.

Monday, February 25, 2013

Barnes and Noble Going Down?

This article talks about how Barnes and Noble is losing profit with the Nook and it's reading tablets/online store. Do you think that the company will "go away" like Borders did? Or are you hoping the store will stay in business? What are your thoughts on book stores and their importance?

House of Cards

Any TV lovers in the class? Here is a show I think you may like "House of Cards." But before you watch it (on Netflix) here's an article about it. If you took Econ 101 (or other class) with Hannah then you may remember watching a video with the same name.

Just an interesting qoute from the article: "In the real world, federal funding is a fast-dwindling resource, and populist pandering a bigger drag on problem-solving than any individual villainy" - Powerful ain't it?

What do think of the show? Would you watched it?

Just an interesting qoute from the article: "In the real world, federal funding is a fast-dwindling resource, and populist pandering a bigger drag on problem-solving than any individual villainy" - Powerful ain't it?

What do think of the show? Would you watched it?

Less Innovation in the U.S.

The author of this article believes there must be steps to taken

to “return to the productivity growth and broad economic inclusion of the past.”

Do you agree with his premise and conclusion? Is there less innovation happening in the

United States today? Has research and development--and

subsequently, imagination, exploration, experiment and discovery--been sacrificed

for necessary short-term gains in firms?

How should the government, educators and/or individuals look

to prop up innovation and long-term economic growth? Is more

corporate oversight by boards and government regulators necessary?

Thoughts or comments?

Subscribe to:

Posts (Atom)